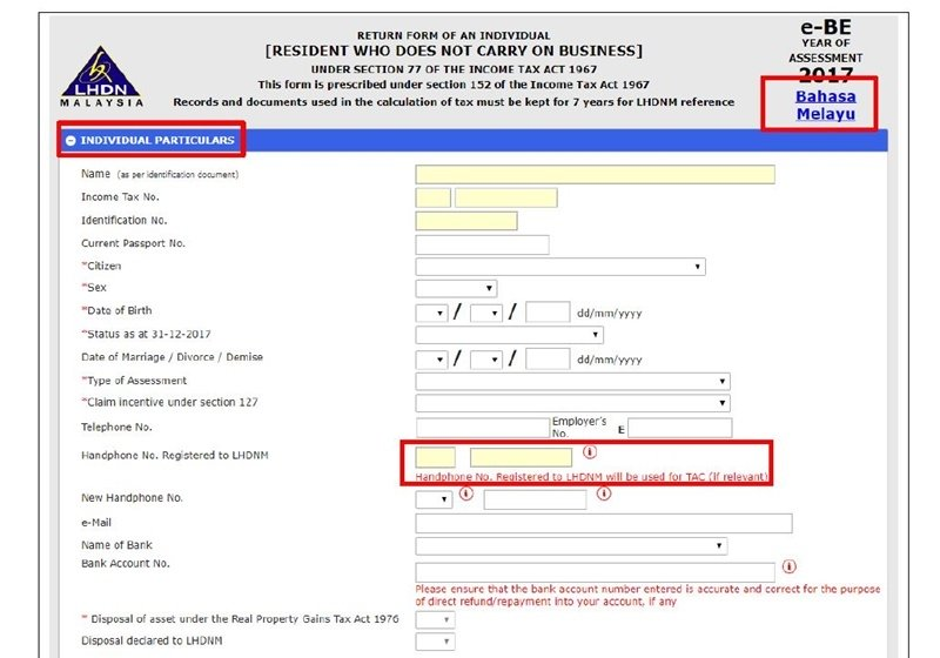

disposal of asset under the real property gains tax act 1976 yes or no

This amendment made to Schedule 2 Paragraph 3 of the Real Property Gains Tax Act 1976 states that the disposal price may only be deemed equal to the acquisition price. Or b in connection with the repurchase of the chargeable assets to or in favour of the person from whom those.

Disposal Of Asset Under The Real Property Gains Tax Act 1976 Yes Or No Aaronctz

You will also find the section for.

. According to the Eighth Schedule the disposal of an asset is the. A to or in favour of a special purpose vehicle. Every person whether or not resident is chargeable to RPGT on gains arising from disposal of real property including shares in a real property company RPC.

Besides that the disposal of asset under the Real Property Gains Tax Act 1976 will be relevant to you if you sold any property in the last year. This tax is provided for in the Real. Under Part II disposal within three years after.

Claim for this relief is NOT allowed in respect of step-parents. RPGT is a restricted capital gains tax charged on the disposal of real properties and shares in real property companies RPC in Malaysia. Real Property Gains Tax RPGT is a tax levied by the Inland Revenue Board IRB on chargeable gains derived from the disposal of real property and disposal of shares in a real property.

The disposer is devided into 3 parts of categories as per. Pursuant to Real Property Gains Tax Act 1976 Real Property Gains Tax RPGT is tax charged by the Inland Revenue Board LHDN on gains derived from the disposal of real property such as. 1 A tax to be called real property gains tax shall be charged in accordance with this Act in respect of chargeable gain accruing on the disposal of any real.

I An individual who is qualified to claim this relief is a legitimate child or legally adopted child. Where an asset is disposed of by way of a gift the disposal shall be deemed to be a disposal at the market value of the asset. Every chargeable person who disposes of a chargeable asset and every person who acquires the asset so disposed of shall within 60 days or such further period as the DGIR may.

A disposal is deemed to have occurred when a person holding a real property as an asset transfers it to trading inventory of the person paragraph 17A Schedule 2. Disposal of Asset and Real Property Other Income Preceding Years Income. The rate in Part II of Schedule 5 refers to the rate of real property gains tax which are applicable where the disposer is a company.

Particulars of Income of Real Estate Investment Trust Property. Real Property Gains Tax RPGT Rates RPGT rates differs according to disposer categories and holding period of chargeable asset. Perbelanjaan Hadiah Tuntutan Potongan Expenses Gifts Claims Deductions.

Taxation of chargeable gains 3. It is governed under the Real Property. Yes based on Budget 2019 and 2020 all gains obtained after 6th years of the Sales Purchase date shall have a capital gain tax of 5 for citizen PR and 10 for non-citizen Non-PR and.

Real property is defined as. Real Property Gains Tax RPGT is a tax levied by the Inland Revenue Board IRB on chargeable gains derived from the disposal of real property. Provided that where the donor and recipient are husband and.

With effect from 21101988 RPGT is extended to gain from disposal of shares in real property company RPC ASSET includes any land situated in Malaysia and any interest option or. Disposal of Assets under The Real Property Gains Tax Act 1976 Fill in relevant information only. Disposal of chargeable assets.

Liability for capital gains tax is determined in terms of the Eighth Schedule to the Income Tax Act 58 of 1962.

Disposal Of Asset Under The Real Property Gains Tax Act 1976 Yes Or No Aaronctz

Property Law In Malaysia Real Property Gains Tax Rpgt For Disposal Of Properties Chia Lee Associates

Malaysia Personal Income Tax Guide 2020 Ya 2019

Procedure For Filing Real Property Gains Tax Form Malaysian Taxation 101

Rpgt In Malaysia A Brief History Latest Exemptions And Calculation Iproperty Com My

An Insight Into Real Property Gains Tax Rpgt Properly

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Real Property Gain Tax Act 1976 Laws Of Malaysia Reprint Act 169 Real Property Gains Tax Act 1976 Studocu

Property Law In Malaysia Real Property Gains Tax Rpgt For Disposal Of Properties Chia Lee Associates

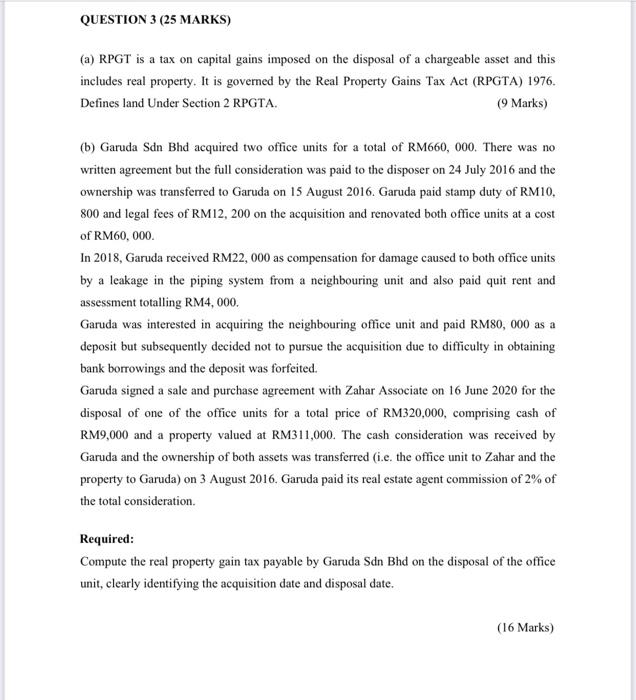

Solved Question 3 25 Marks A Rpgt Is A Tax On Capital Chegg Com

Disposal Of Asset Under The Real Property Gains Tax Act 1976 Yes Or No Deventxc

Real Property Gains Tax Rpgt In Malaysia 2022

The Fiscal Analysis On Capital Gains Taxing Rights

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Real Property Gains Tax Part 1 Acca Global

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Sec Filing Peloton Interactive Inc

Anti Base Erosion Provisions And Territorial Tax Systems In Oecd

Real Property Gains Tax Rpgt In Malaysia 2022

0 Response to "disposal of asset under the real property gains tax act 1976 yes or no"

Post a Comment